nj property tax relief homestead benefit

As unveiled last week the Governor is proposing to replace the Homestead Benefit program with the creation of a new nearly 900 million program known as ANCHOR the Affordable New Jersey Communities for Homeowners and Renters ANCHOR Property Tax Relief Program. This article will go over all NJ property tax relief programs and recommend a personalized guide to help you.

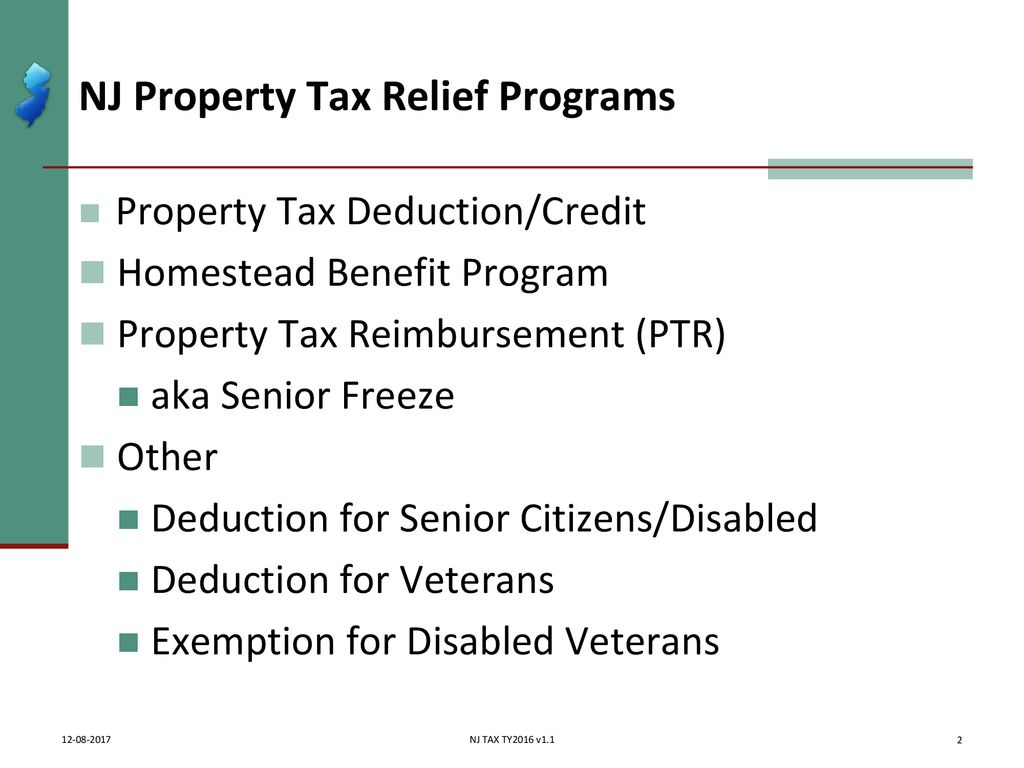

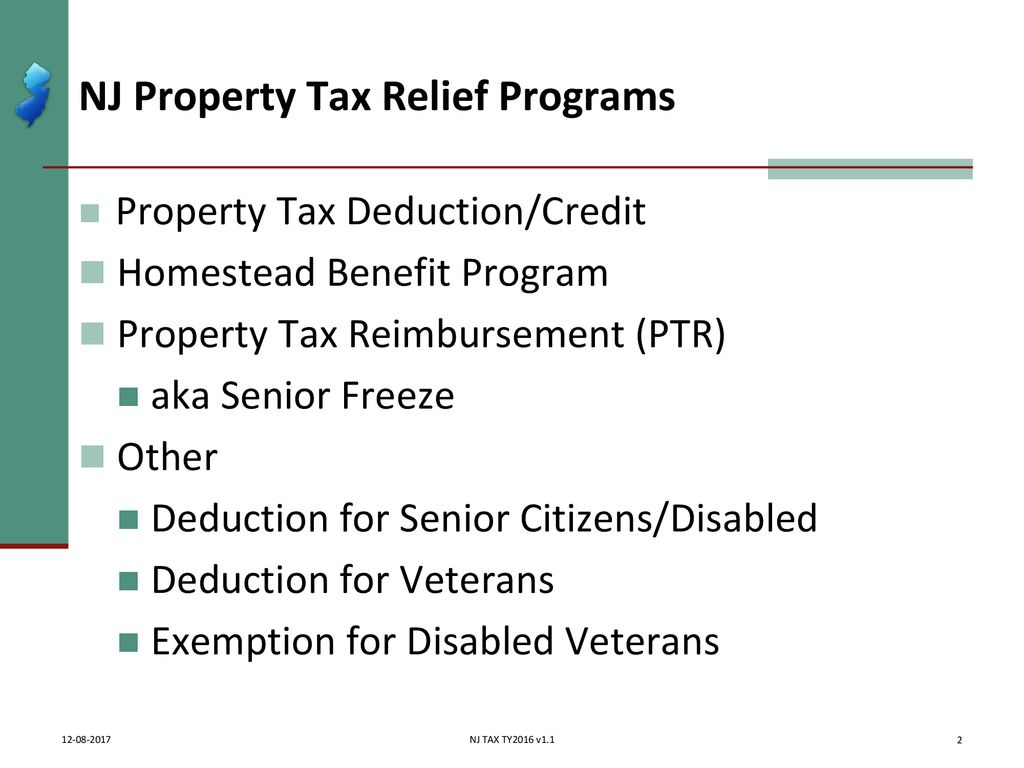

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Just how much property tax relief would people see.

. Under a proposal Murphy unveiled Thursday New Jersey homeowners making up to 250000 annually would be eligible to receive state-funded property-tax relief benefits. Phil Murphy announced Thursday his administration will extend property tax relief to about 18 million New Jersey households by replacing the states Homestead Benefit program. The home was subject to local property taxes and the 2018 property taxes were paid.

To ask questions please call 1-888-238-1233. Most homeowners receive a benefit in the form of a credit which reduces their property taxes. The proposal the Affordable New Jersey Communities for Homeowners and Renters ANCHOR Property Tax Relief Program would.

Property must be your principal residence. The program provides property tax relief to eligible homeowners and for most homeowners the benefit is distributed to your municipality in the form of a credit that reduces your property taxes. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

2017 filing status single. Amounts you receive under the Homestead Benefit Program are in addition to the States other property tax relief programs. Phil Murphy announced more homeowners and renters would receive property tax relief under his new program- ANCHOR- which would replace the Homestead Benefit Program.

Recipients permanent legal residence was in New Jersey. Property tax relief to eligible homeowners is provided by the homestead benefit program. The latest round of benefits scheduled to be paid in May 2022 are intended to offset the property-tax bills from 2018.

The total amount of all property tax relief benefits you receive Homestead Benefit Senior Freeze Property Tax Deduction for senior citizensdisabled persons and Property Tax Deduction for veterans cannot be more than. To file an application online or get more information click here. For information about State Property Tax Relief Programs including eligibility criterion and potential deduction or credit.

To file an application by phone please call 1-877-658-2972. Most homeowners will receive their benefits as credits on their property tax bills. Same old end run.

NEW JERSEY - New Jersey Gov. What Is Nj Homestead Benefit. Also know is there a NJ Homestead Rebate for 2019.

Property tax relief comes in different shapes and forms in New Jerseyit can be a tax freeze a deduction or a benefit programNJ also provides various property tax exemptions you can apply for to lower your taxes. Enough already said Murphy in Fair Lawn. That would add at least 100000 to the current income cutoffs for direct property-tax relief benefits.

NJ Property Tax ReliefA Relief for Your Wallet. Earlier this year NJ Spotlight News detailed how Murphys first draft of the fiscal year 2022 spending plan called for continuing the practice of inserting technical language into the annual budget to keep property-tax bills from. 2017 New Jersey gross income.

The total amount of all property tax relief benefits you receive Homestead Benefit Senior Freeze Property Tax Deduction for senior citizensdisabled persons and Property Tax Deduction for veterans cannot be more than the property taxes paid on. You do not need to reapply or take any action to receive this additional benefit. ANCHOR will benefit more than 115 million homeowners double the amount.

Your 2017 Homestead Benefit is based on your. Homestead Benefit credits will be applied to the following quarter on accounts that have been prepaid. Now the average Homestead Benefit is about 490 and it is calculated based on the 2006 tax year according to.

If no property taxes were assessed on the residence for 2006 we will determine the amount of property taxes that would have been due by using the current assessed value and the 2006 property tax rate. Most eligible homeowners received their 2016 Homestead Benefit property tax relief around May 1 2019 in the form of a credit on their second-quarter property tax bill. The information on the property tax relief program is based on the tax year.

E-mail the state for Homestead rebate questions. Homeowners and certain tenants may be eligible. The property tax relief was only at levels it was supposed to be for one year in 2007.

The ANCHOR program will build upon and improve upon its predecessor the current homestead benefit by tripling the number of residents receiving property tax relief. The benefit amount will be calculated based on 2017 property taxes for each home. Currently the average property tax benefit is 626 with eligibility limited to homeowners making 75000 or less if.

Phil Murphy on Thursday announced a 900 million replacement for the aging and perennially underfunded Homestead Benefit Program the latest plan in Murphys second-term push to make New Jersey more affordable. Increasing that income threshold would allow the Murphy administration to.

Murphy Proposes New Direct Property Tax Relief Program New Jersey Monitor

Senior Freeze Homestead Benefit Programs River Vale Nj

The Different Types Of Candles And Their Benefits And Specialities Honey Candle Beeswax Candles Candle Making

When It Comes To Estate Planning It Pays To Consider Each And Every Option For Protecting Your Legacy One Of The Be Estate Planning Life Estate Things To Come

Exclusive Sri Lanka Halts Imports Of Johnson Johnson Baby Powder Pending Asbestos Tests Johnson And Johnson Baby Powder Talc Powder

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

/gettyimages-1197184592-2048x2048-22e8a8e779514a43a8347a0b583c1813.jpg)

Property Tax Exemptions For Seniors

Governor Phil Murphy Tax Relief Is A Critical Component Of A Stronger And Fairer New Jersey With Middle Class Tax Rebates An Expansion Of Our Earned Income Tax Credit The Long Overdue Updating

New Jersey Property Tax Relief Goes Down As One Tax Break Goes Up Government Finance Officers Association Of Nj

Memorial Day Weekend In Georgia The Hank Miller Team Antebellum Homes Antebellum Home Gothic Revival Architecture

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Confident Care Corp Home Health Aide Home Health Care

Quit Claim Deed Pdf Quites Quitclaim Deed Words

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Explainer Why You Haven T Seen Your Homestead Tax Rebate Lately Whyy