does workers comp deduct taxes

Since workers compensation benefits are not taxable the Internal Revenue Service does not allow taxpayers to deduct their awards. Note that if you reported wages compensation you should have entered workers compensation insurance in the.

How Is Corporation Tax Calculated Jf Financial

Does Workers Comp Count as Income.

. Amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if theyre paid under a workers compensation act or a statute in the nature of a workers compensation act. Workers compensation for an occupational sickness or injury if paid under a workers compensation act or similar law. Are Taxes Taken Out of Workers Compensation Payments.

Workers Compensation Benefits and Taxation. You will also not likely receive any tax documents on the. Workers compensation benefits and settlements are fully tax-exempt which means you do not have to pay taxes.

The answer is no. Since workers compensation is considered necessary by law it is also a deductible expense on this front. Whether you have received weekly payments or a lump sum federal law does not allow it.

Retained after 3000 lb. New Jersey workers compensation rates expected to be flat in 2020. An employees workers compensation claim is approved by OWCP on 12012009.

The employee submits Forms CA-7 CA-7a and supporting medical documentation to WCC on 01012011. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel. See reviews photos directions phone numbers and more for the best Employee Benefits Worker Compensation Attorneys in Piscataway NJ.

It qualifies as an ordinary expense and is considered. Any business would then consider a workers compensation insurance policy to be a normal business expense. Workers compensation settlements and weekly payments are not subject to income taxes.

Report the amount on line 14400 of your Income Tax and Benefit Return to calculate your eligibility for any other federal or provincial benefits. Compensation from workers comp earned from occupational injuries or illnesses is fully tax-exempt provided the insurance carrier adheres to state workers compensation laws. Provides that employers and workers compensation insurance carriers shall be reimbursed for the workers compensation benefits paid to the claimant out of the claimants third party recovery after deductions for the claimants third party claim expenses and attorneys fees.

In most states mandatory workers computation is a deductible state tax but that depends on state law. At line 25000 of your tax return take an offsetting deduction for the amount shown in box 10 of your T5007 slip. Compressor fell on workers legs facilitating payment of bills and other issues including negotiating settlement.

The employee must apply for Leave Buy Back within one year of the date OWCP approved the claim. Injured workers can receive checks from their settlements without having to list the amount as earned income or paying taxes on the total amount at the conclusion of the year. No taxes are usually not taken out of your workers comp payments.

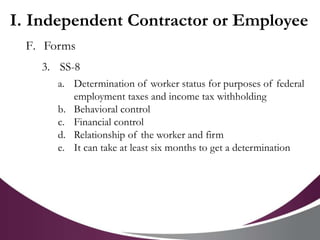

The state was up four spots compared to a similar study conducted in 2016. According to IRS Publication 525 page 19 does workers comp count as earned income for federal income taxes. Mandatory workers compensation insurance is normally withheld for employees not independent contractors but the law is a state law and is different in every state.

NJ rates are approximately 150 higher than the median rates in the country. The leave buy back application is denied as untimely. Whether you received wage loss benefits on a weekly basis or a lump sum settlement workers compensation is not taxable.

Workers comp insurance meets both requirements to be considered tax deductible. When filing taxes you do not need to add workers comp to your earned income. No in most cases.

Yes workers comp payments and benefits that employers pay to their employees are deductible business expenses. However business owners can deduct their workers compensation taxes or payments to cover insurance premiums. Include the T5007 slip with your paper return.

Consequently you are not expected to include your benefits in your tax returns. New Jersey workers compensation rates currently rank on average as the 3rd highest in the country according to a 2018 study. These are tax exempt benefits with only rare exceptions.

Repayment of Workers Compensation Benefits. The following payments are not taxable. Workers Compensation Insurance may be reported under Insurance Premiums in the Common Business Expenses section under Deductions.

Report the amount shown in box 14 of your T4 slips on line 10100 of your Income Tax and Benefit Return. IRS Publication 907 reads as follows. Income from the WCB will be reported in Box 10 of the T5007 slip.

See reviews photos directions phone numbers and more for Coventry Workers Comp locations in Piscataway NJ. The Division of Workers Compensation is responsible for the administration of the New Jersey Workers Compensation Act NJSA. Since this income is not taxable you will deduct it on line 25000.

Where do I enter the cost of my workers comp insurance for the deductions on my corporate return 1120s. Is workers comp tax-deductible for employers. Workers compensation benefits are not counted as taxable income on both the state and federal level.

The quick answer is that generally workers compensation benefits are not taxable. Many people on workers compensation get worried about the tax implications. This includes lump sum payments intended to cover injury-related losses.

This is accomplished by. If you are not receiving Social Security Disability benefits your workers comp will generally not be counted as taxable income. The worker does not have the right to bring a civil action against the employer for pain and suffering or other damages except in cases of intentional acts.

Business owners are able to deduct the costs of required insurance payments from their tax liability if they are necessary for their business operations. In most cases they wont pay taxes on workers comp benefits. The question of whether or not workers comp benefits must be claimed on your taxes can be answered in one word.

In the end though if youre receiving straight workers comp benefits paid out by your employers insurance company you dont have to pay any taxes on those funds you receive. Your workers compensation benefits will be subtracted from your taxable income.

Paying Taxes On Workers Compensation In Florida Johnson Gilbert P A

Unbiased Report Exposes The Unanswered Questions On Spreadsheet For Trucking Comp Spreadsheet Template Excel Spreadsheets Templates Business Plan Template Free

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

How To Deduct Workers Compensation From Federal Tax Form 1040

Do I Have To Pay Taxes On A Workers Comp Payout Bachus Schanker

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Injury Attorneys

Q A When Does Tax Apply To Compensation Ftadviser Com

Fica Taxes Unemployment Insurance Workers Comp For Owners

Payroll Journal Entries For Wages Accountingcoach

How Is Corporation Tax Calculated Jf Financial

Working Through A Limited Company Low Incomes Tax Reform Group

Compensation And Employment Tax Issues

What Can You Include In Tax Write Offs

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

The Impact Of Share Based Compensation Strategic Finance

How Is Corporation Tax Calculated Jf Financial

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options